2018 in Numbers

As the first full quarter of 2019 ends, we wanted to take a look at Social Leverage in 2018. Across our funds, we invested in 4 new companies, participated in 8 up rounds and saw 3 exits.

When we make initial seed stage investments, our portfolio companies often raise $2M or less. Our 4 new investments in 2018 brought in a combined total of less than $5M in their seed rounds. Once we make the initial investment, we work with the CEO to help the companies reach milestones and to scale. Our scaled companies, brought in significant dollars, raising over $450M in 2018.

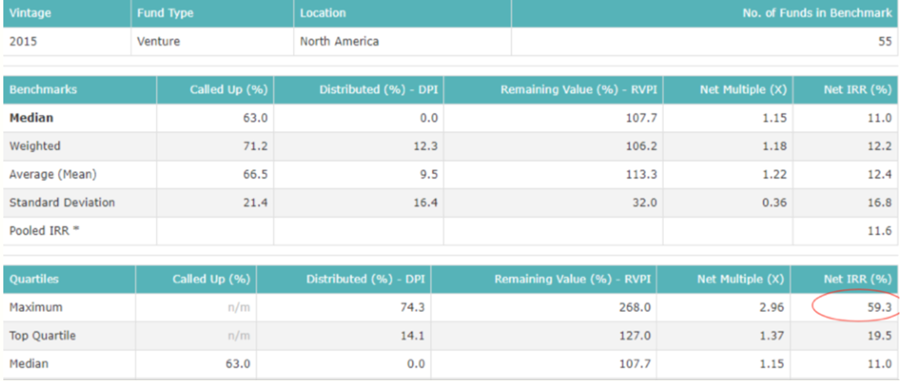

First Republic used Preqin data to issue a report which showed both our Fund I and Fund II as top quartile funds. This report highlights Fund II as a top performing fund for both Micro VC and general VC funds for 2007-2015 vintages. The same Preqin data shows that as of the end of Q2 2018, our Fund II is the number one performing 2015 vintage fund in the country, based on its then current IRR of 59.3%:

New Portfolio Companies

We had the privilege of backing the founders of the following four companies in 2018. In each case, we're honored that they chose us not solely for our capital but also for the leverage that we hope to add to their businesses.

RallyRd is democratizing the blue-chip collector car market by making it available to average investors. This market has outperformed the S&P over the past 20 years. There is a disproportional amount of interest in the asset class, while only a select few can actually participate. The team at RallyRd has built a beautiful application allowing any investor to buy a fractionalized share of a car. The magic which makes this work is that each car is actually an SEC registered investment vehicle. If you have an iPhone, get the app and try it for yourself. If you're looking for some more insights, take a look at Tom's post on the company.

RallyRd successfully raised a Series A, less than a year after our initial investment in January 2018. Our friend Greg Bettinelli of Upfront Ventures led the round.

Coinmine is a consumer product company. Their first creation is a beautiful device which allows anyone to easily and efficiently mine cryptocurrency. Over 25 million people in the US own crypto, but very few are involved on any other level because it is too hard to setup, maintain and adapt. Coinmine is changing that with beautiful hardware coupled with an intuitive app. Howard penned a post that discusses this company in more detail, including their initial launch.

Manscaped is a direct to consumer company specializing in "men's below the belt grooming". Although non-traditional, Manscaped's creative messaging has resonated with their target demographic.

Koyfin is a financial analytics platform. Koyfin provides users with market insights through dashboards, graphs and other data visualizations. Howard called Koyfin "The Ultimate Markets Dashboard" and followed up with a market analysis leveraging Koyfin, highlighting some of its capabilities.

Follow On Rounds

Some of the more significant follow on financings from 2018 include:

Exits

Three of our portfolio companies were acquired in 2018.

Joist, the #1 app for contractors, was acquired by EverCommerce. Joist was a Fund I company.

Datafox, a provider of insightful data to prioritize accounts, enrich leads, refresh and harmonize CRM data and identify new prospects, was acquired by Oracle. Datafox was also a Fund I company.

Sapho, the only employee experience portal designed for the digital workplace, was acquired by Citrix. Sapho was a Fund II company.

It's bittersweet to have these companies and founders leave our portfolio. That said, we're grateful for the time we spent together. And we feel encouraged that we'll have the opportunity to work with the founders again, down the road.

More from Social Leverage Here's a look at some of our blog posts and activities from the past year:

Raising Fund III: It's been a while in the making, but we're looking forward to closing out the fund in the next 20 days. We now have 9 portfolio companies, three of which have raised significant Series A rounds.

Stocktoberfest East: Stocktwits held its annual NY event, with some incredible speakers sharing their wisdom.

Invest with the Best: Listen to Howard Lindzon on Patrick O'Shaughnessy's "Invest with the Best" podcast

Stoctoberfest West: Stocktwits later headed out West to Coronado for another day of great fin-tech content.

Start of 2019

We've had a fast start to 2019 with 2 new investments in Fund III so far. We're looking forward to what the year has in store and sharing the update again in 2020!